Managed Detection and Response (MDR) for FinTech

UnderDefense MAXI MDR delivers robust 24/7 security for Paytech, Digital Banking, PFM, InsurTech, Lending, and Crypto, ensuring your data and operations are always protected.

Request a Quote

Finance firms' losses per data breach

Time fintech services companies need to identify a breach

Recovery time to restore operations after Ransomware

SEC regulation fine

All-encompassing protection, 24/7

Breach avoidance via automated remediation

Your existing tools work effectively as an orchestra

Flexible cooperation models

Threat Detection, crafted for your business and use cases

Experts in threat hunting as an extension to your team

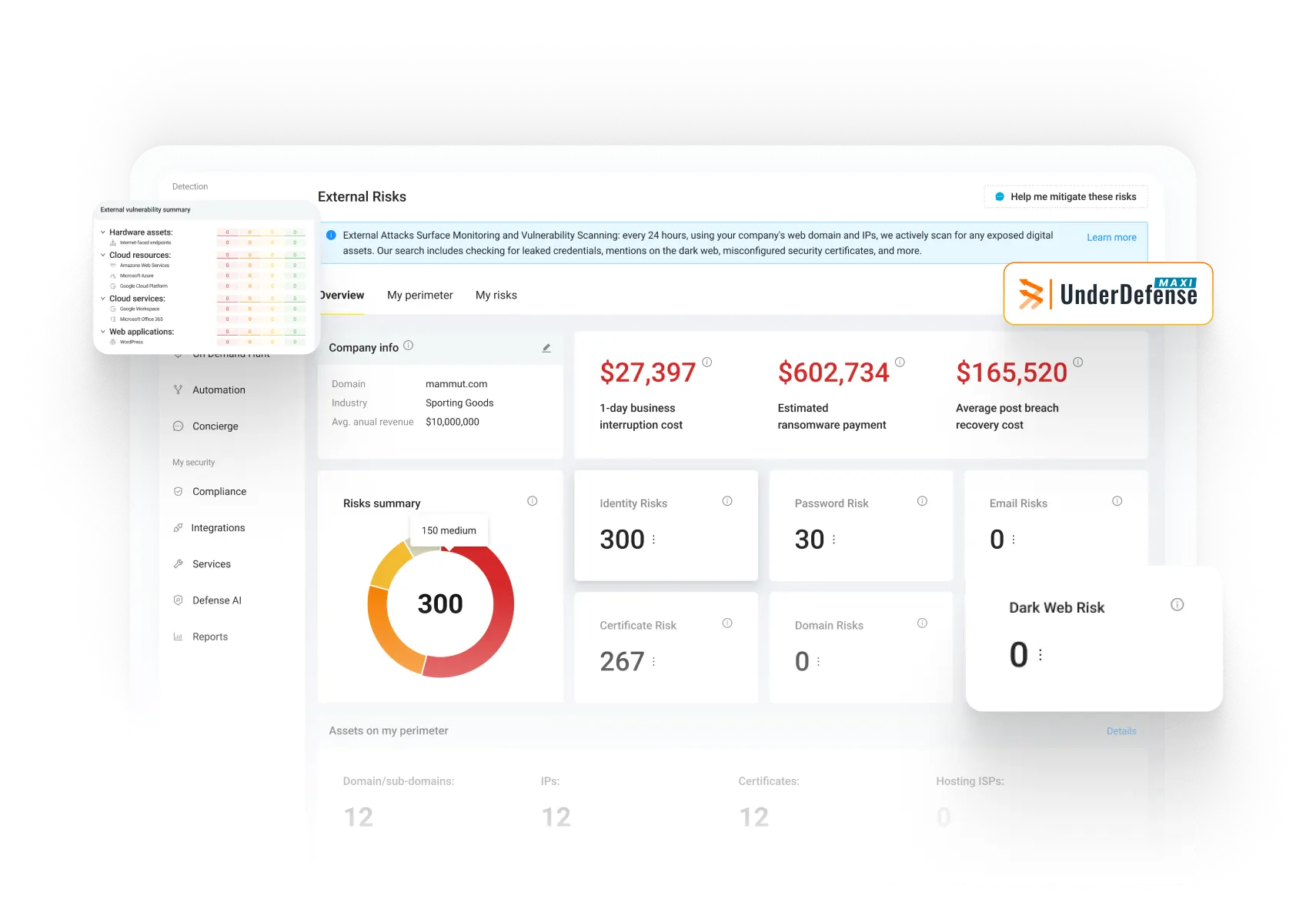

Exposure Management Services

Managed Detection & Response

Digital Forensics and Incident Response

- See what our SOC team sees: Get real-time access to the monitoring dashboard to understand how they defend your business.

- Be the master of your domain: Take full control over your environment settings, and ensure your defenses align with your needs.

- Automate like a pro: Utilize pre-defined incident response playbooks or create your own, ensuring fast and effective action against threats.

- Tap into expert guidance: Get 24/7 access to experienced security professionals ready to answer your questions and offer insights.

- Measure and improve: Assess your cybersec effectiveness with detailed reports, to make data-driven decisions.

Customer testimonials

Experts. Finalists.Winners.

Our customers say it best

Frequently asked questions

Why do financial institutions need MDR?

Financial institutions are prime targets for cyberattacks due to the sensitive data they hold. In-house security teams may struggle to keep pace with sophisticated threats, limited resources, and the ever-evolving landscape. UnderDefense MDR provides 24/7 expert monitoring, advanced threat detection, and rapid response, freeing your team to focus on core business needs while ensuring robust security.

What are some specific features to look for in an MDR solution for banking?

- Deep understanding of financial regulations: Ensure compliance with strict industry standards like PCI DSS and GDPR.

- Expertise in financial threats: Focus on fraud detection, money laundering prevention, and insider threat monitoring.

- Advanced threat detection & response: Leverage cutting-edge technologies to identify and neutralize emerging threats quickly.

- Data breach prevention: Implement proactive measures to safeguard sensitive customer information.

- Incident response plans: Have clear protocols for rapid containment and recovery from security breaches.